On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan is supported by tax, departmental, and federal revenues, as well as the use of trust fund resources built up in recent years.

On January 24th, Governor Healey released her administration’s budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in childcare, healthcare, and transportation; as well as $20.3 billion in gross spending for the state’s MassHealth program.

Compared to FY 2024, gross state spending on MassHealth increases by $770 million or 3.9 percent; and the net cost of the program increases by approximately $279 million or 3.6 percent. In total, MassHealth accounts for 35 percent of overall spending in the Governor’s budget.

On January 24th, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal, with significant investments in childcare, education, and transportation. The $58.13 billion spending plan is a $2.1 billion increase (3.7 percent) over the FY 2024 General Appropriations Act (GAA). This brief focuses on workforce spending in the Governor’s proposal, where investments occur, and how proposed funding compares to the FY 2024 GAA.

Authored by: Pablo Suarez

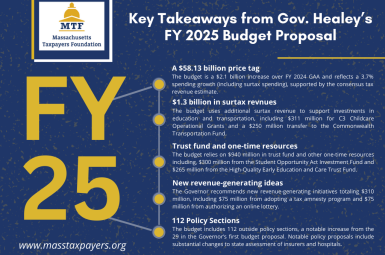

The Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal on January 24, 2024. The Governor’s budget proposes $58.13 billion in total on-budget spending including $1.3 billion in spending supported by income surtax revenues directed to education and transportation programs. The proposal increases funding over the FY 2024 General Appropriations Act (GAA) by $2.1 billion (3.7 percent), when including surtax revenue allocations.

The Healey administration filed its Fiscal Year (FY) 2025 budget proposal on January 24th, totaling $58.13 billion. The spending plan includes critical investments in healthcare and education, as well as a notable funding increase for transportation supported by new income surtax revenues.

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan includes $1.3 billion in proposed spending supported by income surtax revenues, an increase of $300 million over the $1 billion surtax spending cap established for the FY 2024 General Appropriations Act (GAA).

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in child care, healthcare, and transportation; as well as sizeable increases in support for local aid to cities and towns and K-12 education.

Earlier today, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal. The $58.13 billion spending plan includes critical investments in childcare, education, and transportation; and $1.3 billion in spending supported by income surtax revenues. The Governor’s budget increases funding over the FY 2024 General Appropriations Act (GAA) by $2.1 billion (3.7 percent); a rate of growth that reflects the modest revenue expectations for the upcoming fiscal year.

On January 8th, budget leaders from the House, Senate, and Administration announced a $40.202 billion consensus tax revenue figure for the Fiscal Year (FY) 2025 budget, excluding surtax revenue. Budget writers expect tax revenues to grow by $792 million (2 percent) over estimated FY 2024 collections of $39.410 billion (Figure 1). The consensus tax revenue agreement also establishes a $1.3 billion cap on the use of income surtax revenues in the FY 2025 budget, a $300 million increase over the amount of surtax-supported spending in FY 2024.

On December 4th, the Massachusetts Taxpayers Foundation (MTF), along with the Department of Revenue (DOR) and other economic experts participated in the annual Consensus Revenue Hearing. The hearing offers administration and legislative budget leaders an opportunity to reassess revenue assumptions for Fiscal Year (FY) 2024 and evaluate the resources that will be available to support budgeted spending in FY 2025. This brief uses the Consensus Revenue Hearing as the backdrop to examine both of these issues.