Displaying 91–100 of 634

Feb 26, 2024

BUDGET & TAXES > Budget > FY 2025

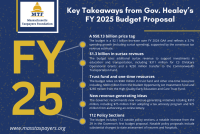

The Healey administration filed its Fiscal Year (FY) 2025 budget proposal on January 24th, totaling $58.13 billion. The spending plan includes critical investments in healthcare and education, as well as a notable funding increase for transportation...

BUDGET & TAXES > Budget > FY 2025

Feb 23, 2024

BUDGET & TAXES > Budget > FY 2025

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan includes $1.3 billion in proposed spending supported by income surtax revenues, an increase of $300 million over the $1...

BUDGET & TAXES > Budget > FY 2025

Feb 14, 2024

BUDGET & TAXES > Budget > FY 2025

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in child care, healthcare, and transportation; as well as sizeable increases in support for...

BUDGET & TAXES > Budget > FY 2025

Feb 07, 2024

WORKFORCE DEVELOPMENT

The following brief provides an analysis of state workforce investments in state budgets from FY 2019 to FY 2023 organized in MTF’s training opportunities for state-serving populations workforce category. As MTF noted in our earlier introductory...

WORKFORCE DEVELOPMENT

Jan 24, 2024

BUDGET & TAXES > Budget > FY 2025

Earlier today, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal. The $58.13 billion spending plan includes critical investments in childcare, education, and transportation; and $1.3 billion in spending supported...

BUDGET & TAXES > Budget > FY 2025

Jan 16, 2024

HOUSING & REAL ESTATE

On October 18th, the Healey administration unveiled a $4.1 billion housing bond bill, titled the Affordable Homes Act, which combined a new five-year capital funding plan with a variety of policy proposals intended to spur production and accelerate...

HOUSING & REAL ESTATE

Jan 11, 2024

BUDGET & TAXES > Budget > FY 2024

Earlier this week, the Healey administration announced a $1 billion tax revenue shortfall for FY 2024, downgrading the revenue benchmark from $40.41 billion to $39.41 billion. They also released a plan to solve the shortfall which includes...

BUDGET & TAXES > Budget > FY 2024

Jan 08, 2024

BUDGET & TAXES > Budget > FY 2025

On January 8th, budget leaders from the House, Senate, and Administration announced a $40.202 billion consensus tax revenue figure for the Fiscal Year (FY) 2025 budget, excluding surtax revenue. Budget writers expect tax revenues to grow by $792...

BUDGET & TAXES > Budget > FY 2025

Jan 08, 2024

BUDGET & TAXES > Budget > FY 2024

The Healey Administration announced a $1 billion revenue shortfall, attributable to below benchmark revenue collections to date.The FY 2024 revenue benchmark has been downgraded to $39.410 billion.After accounting for the shortfall and the impacts of...

BUDGET & TAXES > Budget > FY 2024

Dec 20, 2023

TRANSPORTATION

On November 16, the MBTA presented an updated analysis of its State of Good Repair (SGR) Index, which measures the Authority’s capital asset needs, to the Board of Directors (here) in which it revised the SGR Index to $24.5 billion from the most...

TRANSPORTATION