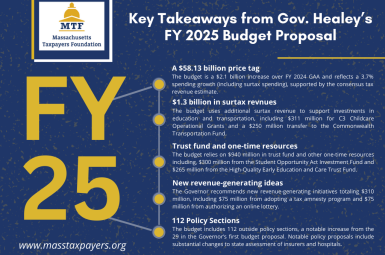

Earlier today, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal. The $58.13 billion spending plan includes critical investments in childcare, education, and transportation; and $1.3 billion in spending supported by income surtax revenues. The Governor’s budget increases funding over the FY 2024 General Appropriations Act (GAA) by $2.1 billion (3.7 percent); a rate of growth that reflects the modest revenue expectations for the upcoming fiscal year.

Earlier this week, the Healey administration announced a $1 billion tax revenue shortfall for FY 2024, downgrading the revenue benchmark from $40.41 billion to $39.41 billion. They also released a plan to solve the shortfall which includes approximately $375 million in net mid-year (9C) budget cuts. In total, 66 budget line-items were reduced by $545 million in gross spending. These cuts are accompanied by approximately $169 million in lost revenue, resulting in an estimated net impact of $375 million.

On January 8th, budget leaders from the House, Senate, and Administration announced a $40.202 billion consensus tax revenue figure for the Fiscal Year (FY) 2025 budget, excluding surtax revenue. Budget writers expect tax revenues to grow by $792 million (2 percent) over estimated FY 2024 collections of $39.410 billion (Figure 1). The consensus tax revenue agreement also establishes a $1.3 billion cap on the use of income surtax revenues in the FY 2025 budget, a $300 million increase over the amount of surtax-supported spending in FY 2024.

The Healey Administration announced a $1 billion revenue shortfall, attributable to below benchmark revenue collections to date.

- The FY 2024 revenue benchmark has been downgraded to $39.410 billion.

- After accounting for the shortfall and the impacts of tax relief, expected FY 2024 revenue collections total $38.833 billion.

Authored by: Meaghan Callahan

On December 4th, the Massachusetts Taxpayers Foundation (MTF), along with the Department of Revenue (DOR) and other economic experts participated in the annual Consensus Revenue Hearing. The hearing offers administration and legislative budget leaders an opportunity to reassess revenue assumptions for Fiscal Year (FY) 2024 and evaluate the resources that will be available to support budgeted spending in FY 2025. This brief uses the Consensus Revenue Hearing as the backdrop to examine both of these issues.

Governor Healey filed her administration’s FY 2023 closeout supplemental budget on September 13th, and versions of the spending bill were passed by the House and Senate on November 8th and 14th, respectively.

On October 19th, the Healey administration announced its plan to pursue the federal funding opportunities available through the Infrastructure Investments and Jobs Act (IIJA), Inflation Reduction Act (IRA), and Creating Helpful Incentives to Produce Semiconductors Act (CHIPS). The proposal would establish a new trust fund – capitalized through interest earnings on the Stabilization Fund – that can be leveraged to draw down on federal funding opportunities, fund PAYGO capital projects, and support debt management strategies.

The Fiscal Year (FY) 2024 budget was signed into law on August 9th, but four months into the new fiscal year, work remains for administrative and legislative budget writers to close the books on FY 2023. This work – typically marked by the passage of a closeout supplemental budget – is completed every year; however, a number of factors impacting FY 2023 make this year’s task more challenging.

Over the last two years, the federal government has made unprecedented investments in transportation, climate resiliency, and economic development infrastructure through three pieces of legislation: the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the Creating Helpful Incentives to Produce Semiconductors Act (CHIPS). Combined, these three bills include over $2 trillion in spending, nearly half of which will be made available to states through competitive grant programs and formula allocations over the next five to ten years.

On August 9th, Governor Healey signed the Fiscal Year (FY) 2024 budget; sending back $272 million in gross spending vetoes ($205 million net), amending 8 outside policy sections, and vetoing one policy section. The Governor’s vetoes eliminate the budget’s reliance on $205 million in one-time resources, which MTF highlighted as a fiscal concern in our Conference Summary. Thirty-three budget accounts are impacted by spending vetoes, with most funding levels being reduced to what was originally proposed in the Governor’s budget.