Displaying 41–50 of 406

Feb 23, 2024

BUDGET & TAXES > Budget > FY 2025

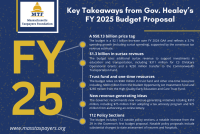

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan includes $1.3 billion in proposed spending supported by income surtax revenues, an increase of $300 million over the $1...

BUDGET & TAXES > Budget > FY 2025

Feb 14, 2024

BUDGET & TAXES > Budget > FY 2025

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in child care, healthcare, and transportation; as well as sizeable increases in support for...

BUDGET & TAXES > Budget > FY 2025

Jan 24, 2024

BUDGET & TAXES > Budget > FY 2025

Earlier today, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal. The $58.13 billion spending plan includes critical investments in childcare, education, and transportation; and $1.3 billion in spending supported...

BUDGET & TAXES > Budget > FY 2025

Jan 11, 2024

BUDGET & TAXES > Budget > FY 2024

Earlier this week, the Healey administration announced a $1 billion tax revenue shortfall for FY 2024, downgrading the revenue benchmark from $40.41 billion to $39.41 billion. They also released a plan to solve the shortfall which includes...

BUDGET & TAXES > Budget > FY 2024

Jan 08, 2024

BUDGET & TAXES > Budget > FY 2025

On January 8th, budget leaders from the House, Senate, and Administration announced a $40.202 billion consensus tax revenue figure for the Fiscal Year (FY) 2025 budget, excluding surtax revenue. Budget writers expect tax revenues to grow by $792...

BUDGET & TAXES > Budget > FY 2025

Jan 08, 2024

BUDGET & TAXES > Budget > FY 2024

The Healey Administration announced a $1 billion revenue shortfall, attributable to below benchmark revenue collections to date.The FY 2024 revenue benchmark has been downgraded to $39.410 billion.After accounting for the shortfall and the impacts of...

BUDGET & TAXES > Budget > FY 2024

Dec 12, 2023

BUDGET & TAXES > Budget > FY 2025

On December 4th, the Massachusetts Taxpayers Foundation (MTF), along with the Department of Revenue (DOR) and other economic experts participated in the annual Consensus Revenue Hearing. The hearing offers administration and legislative budget...

BUDGET & TAXES > Budget > FY 2025

Dec 04, 2023

BUDGET & TAXES > Budget > FY 2025

Tax revenues for Fiscal Year (FY) 2024 and FY 2025 settle into a post-COVID pattern of lower growth as the economy slows, impacts from migration and an aging population emerge (Appendix A), and tax reforms take effect. Excluding revenues related to...

BUDGET & TAXES > Budget > FY 2025

Nov 29, 2023

BUDGET & TAXES > Budget > FY 2023

Governor Healey filed her administration’s FY 2023 closeout supplemental budget on September 13th, and versions of the spending bill were passed by the House and Senate on November 8th and 14th, respectively. While the House and Senate bills largely...

BUDGET & TAXES > Budget > FY 2023

Nov 07, 2023

BUDGET & TAXES > Budget > FY 2024

On October 19th, the Healey administration announced its plan to pursue the federal funding opportunities available through the Infrastructure Investments and Jobs Act (IIJA), Inflation Reduction Act (IRA), and Creating Helpful Incentives to Produce...

BUDGET & TAXES > Budget > FY 2024